Organizing sales transactions is essential for small business success. Here's why and how you can do it:

-

Why It Matters:

- Gain clear financial insights to track performance.

- Simplify tax preparation and catch deductions.

- Detect fraud and unusual activity.

- Make better decisions with accurate data.

-

How to Categorize:

- Group sales into product-based (e.g., inventory, digital products) and service-based revenue (e.g., consulting, subscriptions).

- Create custom categories tailored to your business, like payment methods, sales channels, or seasonal trends.

- Use consistent labels (e.g., codes, dates) for easier tracking.

-

Tools and Tips:

- Use digital tools for real-time tracking, automation, and secure data management.

- Conduct monthly reviews to ensure records stay accurate and relevant.

- Align categories with tax codes to stay compliant.

Organized sales records help you manage cash flow, plan better, and grow your business efficiently. Start by defining categories, using tools, and reviewing regularly.

Types of Sales Categories

Standard Sales Groups

Businesses typically generate revenue through two main avenues: product sales and service income. Product sales involve physical goods that customers can own, while service income is earned by providing expertise or time-based solutions [2].

Here’s a breakdown of these revenue types:

Product-Based Revenue

- Physical inventory sales

- Digital downloads

- Bundled product solutions

- Wholesale transactions

- Retail purchases

Service-Based Revenue

- Professional services

- Consulting fees

- Subscription plans

- Maintenance agreements

- Project-based work

While product sales require managing inventory, service income revolves around effective scheduling and resource allocation [2][3].

Setting Up Business-Specific Categories

To better suit your business, go beyond these standard groups and create tailored categories. The North American Industry Classification System (NAICS) can serve as a helpful starting point [1].

-

Primary Classification

Organize revenue into broad categories. For instance, a home improvement store might divide sales into:- Hardware supplies

- Power tools

- Garden equipment

- Installation services

-

Sub-Category Development

Break down primary categories into more detailed segments for precise tracking:- Men's Apparel: Casual Wear, Business Attire, Accessories

- Women's Apparel: Dresses, Activewear, Outerwear

- Children's Wear: Infant Clothing, Kids' Shoes, School Uniforms

- Seasonal Items: Summer Collection, Winter Gear, Holiday Specials

-

Transaction Tracking

Refine your categories by considering factors like:- Payment methods

- Sales channels

- Customer demographics

- Seasonal trends

- Tax requirements

Tailor these categories to align with your business goals and revisit them regularly to ensure they remain effective.

How to Organize Sales Records

Building Your Account Structure

A well-planned account structure is the backbone of organizing sales records. Disorganized records can lead to higher costs, from initial entry to later corrections [6].

Here’s how to create an effective structure:

-

Define Primary Categories

Identify your main revenue streams based on your business model. For example:- Direct Sales

- Online Transactions

- Wholesale Revenue

- Service Income

-

Establish Recording Standards

Use consistent practices for documentation, such as standard date formats (MM/DD/YYYY), currency symbols ($), uniform transaction IDs, and clear payment method codes. -

Set Up Access Protocols

Define user permissions and data entry guidelines to ensure consistency and security. Brian Hicks, VP of Sales at Belkins, emphasizes:"We have a very systematized follow-up process that keeps our pipeline organized. The biggest standard we have is ensuring that every single active deal in our pipeline has a task set for a future follow-up" [5].

Setting Up Category Labels

Once your account structure is ready, proper labeling ensures better tracking. Research shows that 62% of organizations rely on marketing data that's up to 40% inaccurate [6], making accurate labels a must.

| Label Component | Description | Example |

|---|---|---|

| Category Code | Unique identifier | PRD-2025 |

| Department | Business unit | RETAIL-W |

| Transaction Type | Sale classification | B2B-WHSL |

| Date Stamp | Record creation date | 03/19/2025 |

Tips for labeling:

- Stick to consistent formatting across all records.

- Include clear identifiers for sorting.

- Use simple, clear naming conventions.

- Add status indicators to track progress.

Creating Detailed Sub-Categories

After setting up standardized labels, breaking data into sub-categories helps refine financial insights and improve tracking [6].

Suggested Sub-Category Structure:

-

Transaction Details

Include specifics like:- Payment methods

- Sales channels

- Geographic regions

- Customer segments

-

Financial Tracking

Focus on:- Revenue recognition

- Tax calculations

- Commission structures

- Discount applications

-

Performance Metrics

Monitor metrics such as:- Conversion rates

- Customer acquisition costs

- Pipeline velocity

- Sales cycle duration

Steffen Gorgas advises:

"Choose a tool that organizes documents in meaningful structures. Organize them by customer, sale, or project, rather than by type (e.g., quotation, purchase order, invoice, etc)" [4].

Don’t forget to review regularly - about 20-25% of contact data becomes outdated every year [7].

Tips for Better Sales Organization

Monthly Category Reviews

Holding monthly reviews helps keep your financial records accurate and ensures your sales categories remain effective [8].

Focus on these key areas during your reviews:

- Compare actual performance with budgeted goals across categories.

- Assess whether your current sales groups are still relevant.

- Identify and fix any miscategorized transactions.

- Update category labels as needed.

To make these reviews efficient, follow a structured process:

-

Set a Consistent Schedule

Conduct reviews at the same time each month, ideally in the first week. This gives everyone enough time to gather data and prepare for the meeting [8]. -

Involve Key Team Members

Bring in team members who can provide valuable insights and help make informed decisions [8]. -

Record Updates

Keep track of any changes to your categorization system. Here's an example of what to monitor:Review Element Action Items Frequency Category Structure Check if hierarchy is relevant Monthly Transaction Rules Update classification criteria Quarterly Revenue Streams Review new income sources Monthly Reporting Format Adjust for business needs Quarterly

After completing your review, align categories with tax regulations to stay compliant.

Meeting Tax Requirements

Proper sales categorization is critical for meeting tax obligations and ensuring accurate reporting [9].

Key tax-related tasks include:

- Assigning correct tax categories to products and services [9].

- Keeping track of location-specific tax differences.

- Documenting tax-exempt transactions.

- Creating clear audit trails.

"If you're still not sure which tax category to assign, ask your accountant for help. They have the best insights into what tax categories your items need." – Intuit [9]

Using Data for Business Planning

Once your sales records are well-organized, use that data to guide your business strategies [10].

Here’s how you can leverage it:

-

Track Product Performance

Identify which products are performing well, spot seasonal trends, and look for cross-selling opportunities. -

Monitor Customer Behavior

Study customer purchase patterns to refine pricing, improve marketing campaigns, manage inventory, and develop new products. -

Analyze Revenue

Look for patterns in sales data to uncover growth opportunities. Visual tools can make it easier to spot trends [10].

For instance, Vinsight shared a case where a company tracked its export revenue by region. They found European sales were dropping, North American sales were steady, and Asian sales were growing rapidly - eventually becoming their largest export market [11]. This insight helped them adjust their strategy to focus on Asia.

sbb-itb-326adc9

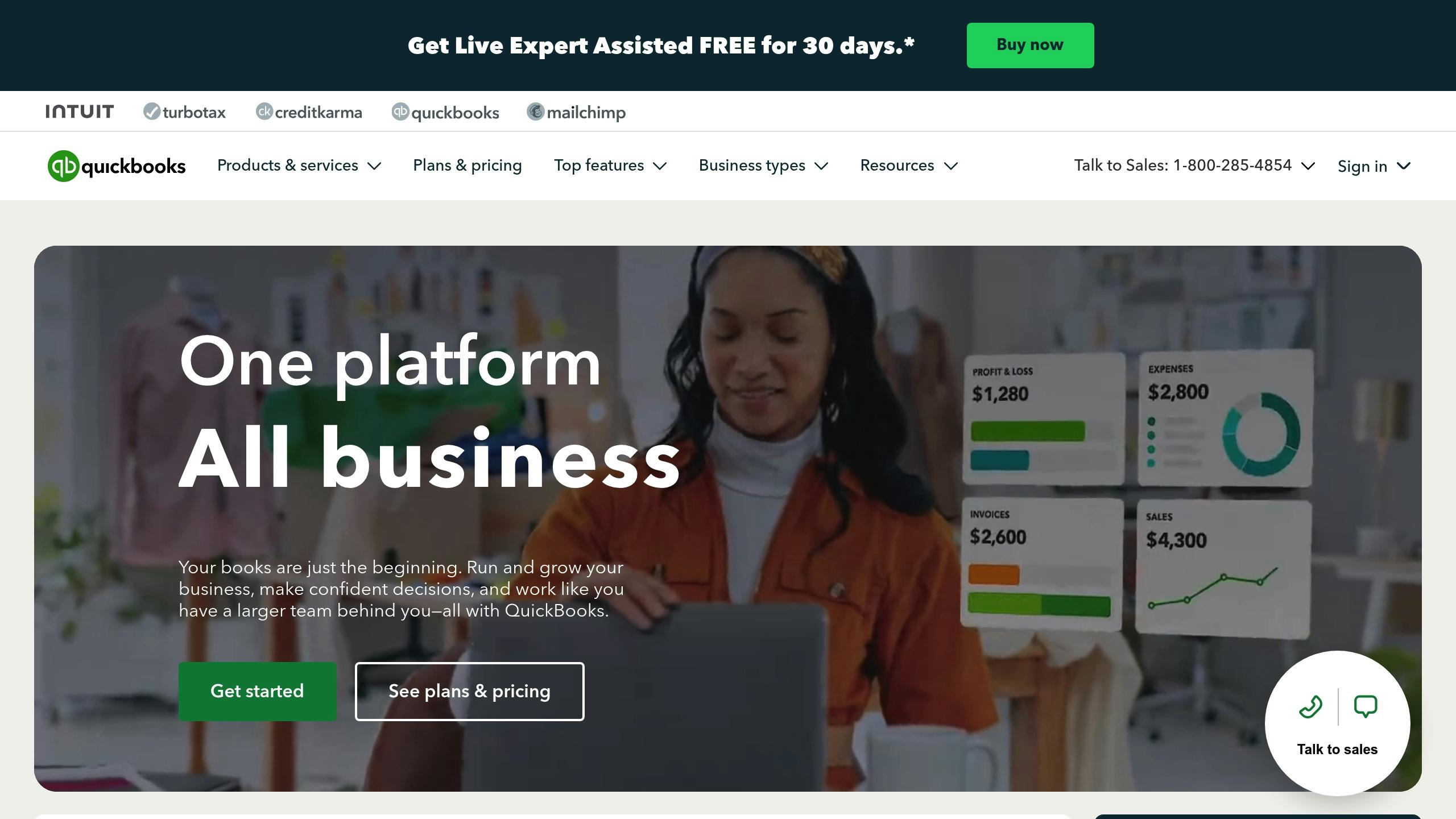

How to Categorize Transactions in QuickBooks Online

Digital Tools for Sales Organization

Digital tools make it easier to manage and organize sales data by simplifying tracking and categorization.

Key Features to Look For

When choosing software for sales organization, focus on features that help you track and categorize transactions effectively [12]:

-

Real-Time Tracking

- Immediate updates on sales

- Live monitoring of performance metrics and KPIs

- Automated alerts for key changes

-

Data Management

- Secure encryption and regular backups

- Customizable reporting options

- Centralized hub offering a full customer overview [13]

| Feature | Business Benefit | Priority Level |

|---|---|---|

| Lead Management | Tracks prospect journey | High |

| Activity Tracking | Monitors sales progress | High |

| Custom Reports | Helps make data-driven decisions | Medium |

| Automation | Cuts down on manual tasks | Medium |

| Mobile Access | Enables management on-the-go | High |

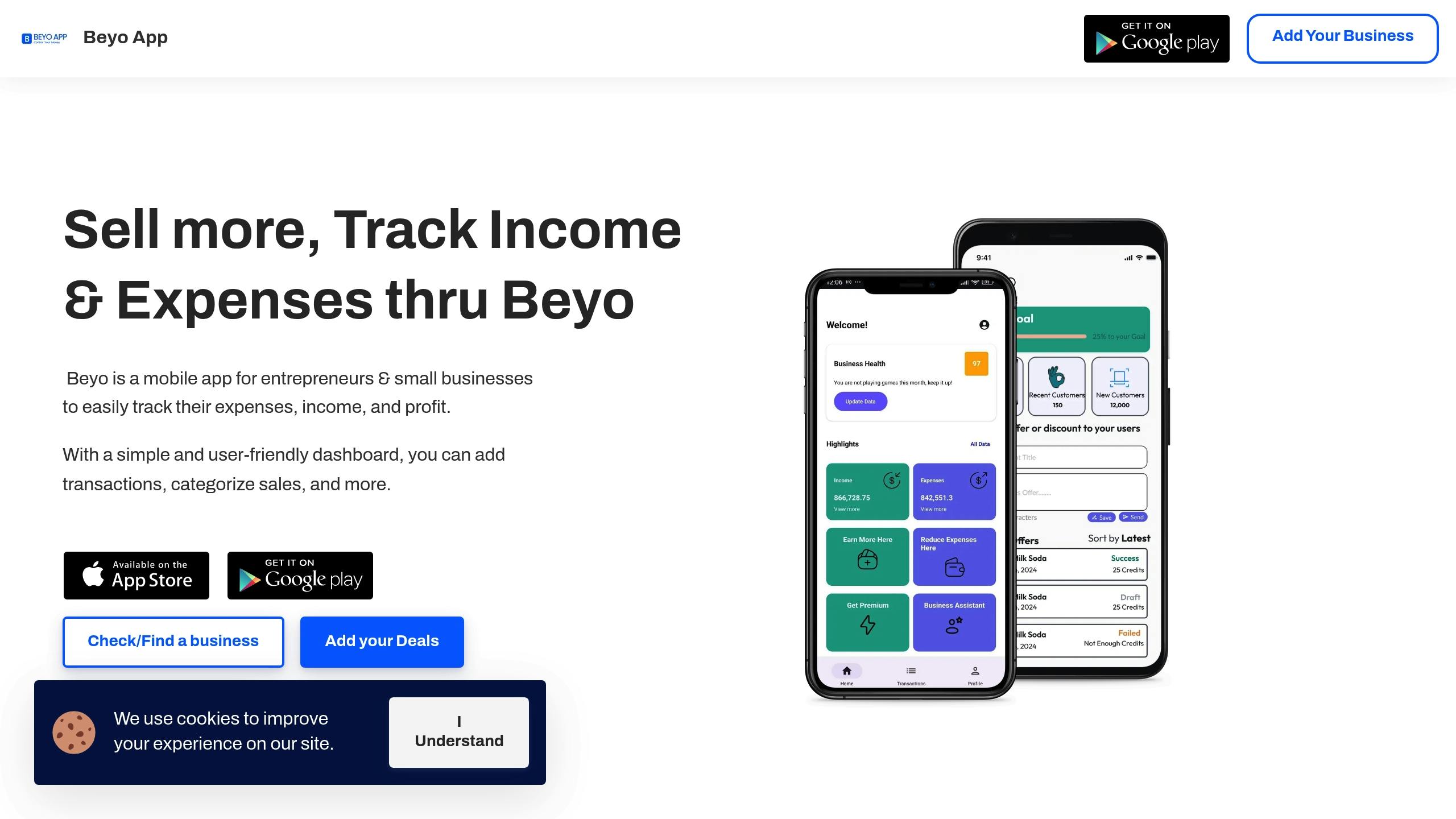

Beyo App Sales Tools

Platforms that simplify sales organization often include these features. For instance, Beyo App provides tools tailored for entrepreneurs and small businesses [14].

Key Features

- Tracks and categorizes transactions

- Monitors income and expenses

- Offers profit analysis tools

- Includes mobile CRM functionality

Integration Options

- Connects with WhatsApp

- SMS and USSD compatibility

- Real-time transaction updates

The Pro version, priced at $2.99/month, offers more advanced features for businesses looking to scale, such as:

- Detailed profit analysis

- Tools for product and service sales

- Advanced transaction categorization

- Enhanced business analytics

For larger businesses, the Enterprise plan includes custom integrations and dedicated support, ensuring smooth sales management across all departments [14].

Next Steps

Now that the advantages of organized transactions are clear, it’s time to put these steps into action and finalize your sales categorization system.

Key Takeaways

- Match your products to specific tax codes to ensure accurate sales tax calculations and compliance [16].

- Assign proper income categories to all products and services you provide [15].

| Phase | Action Items | Expected Outcome |

|---|---|---|

| Setup | Define categories, set tax codes | Clear financial structure |

| Implementation | Configure tools, enable imports | Streamlined processing |

| Monitoring | Review categories, track results | Better decision-making |

These steps are designed to complement the processes you’ve already established.

Steps to Take

-

Tool Configuration

Assign an income account to each product to track income accurately [15]. -

Regular Reviews

Conduct periodic reviews to catch any miscategorized transactions and stay updated on tax reporting practices for compliance [16]. -

Automation Integration

Incorporate automation to import transactions directly from your bank and credit card accounts [17]. This will keep your financial operations running smoothly and efficiently.