Tracking your small business income is essential for financial clarity, better decisions, and tax compliance. It helps you manage cash flow, identify trends, and avoid common mistakes like mixing personal and business finances. Here's a quick overview of what you need to know:

- Why It Matters: 82% of small businesses fail due to poor cash flow management. Tracking income helps prevent this.

- Common Mistakes: Mixing finances, inconsistent recording, and lack of organization are pitfalls to avoid.

- Methods: Choose between paper-based (simple but error-prone) or digital tools (automated and efficient).

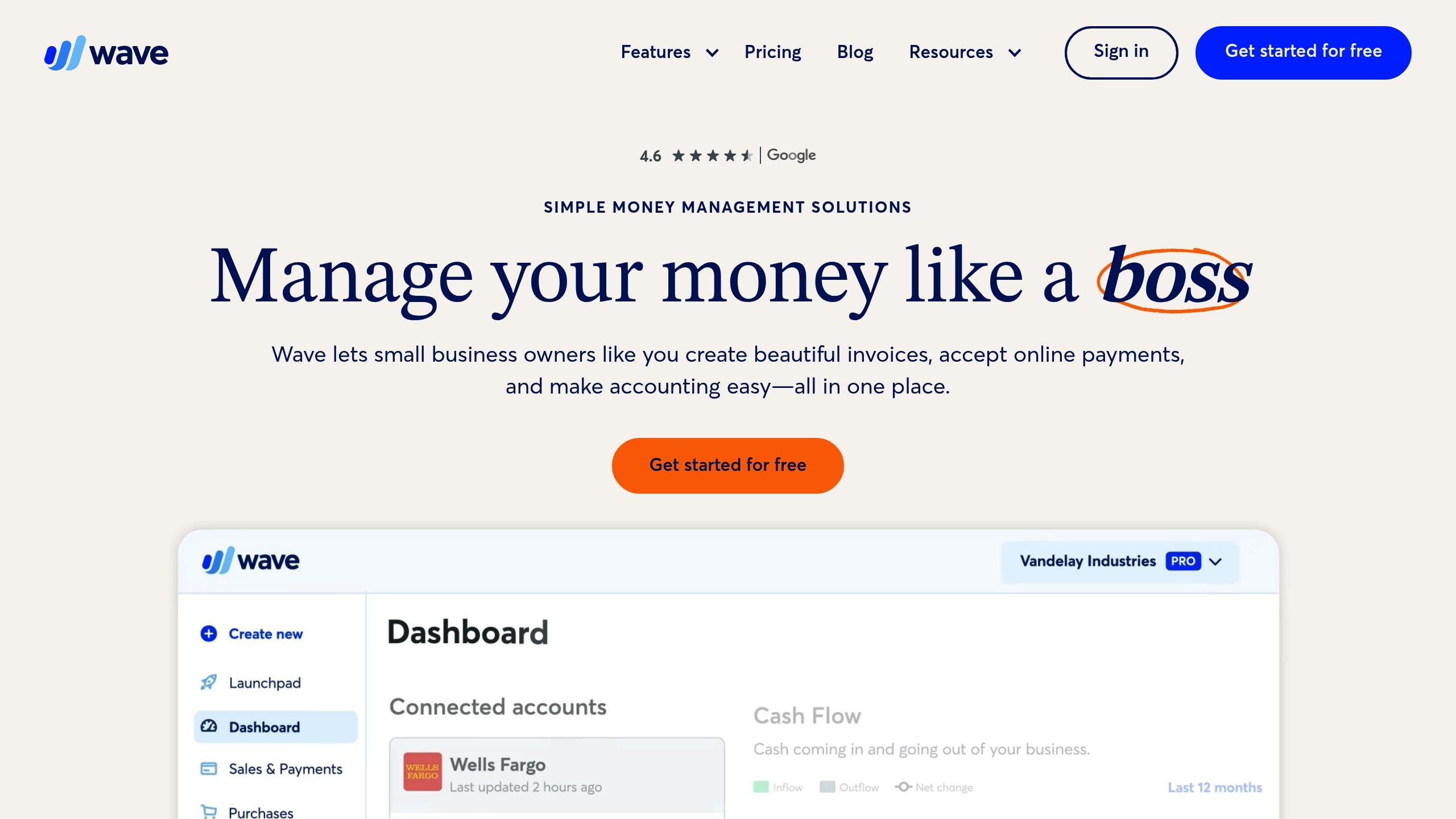

- Top Tools: QuickBooks Online (advanced features) and Wave (free and user-friendly) are great options.

- Best Practices:

- Keep personal and business finances separate.

- Record all income sources, including operating revenue, subscriptions, and passive income.

- Set regular recording schedules (daily, weekly, monthly).

- Use mobile apps for faster and more secure tracking.

Get started today by choosing a method, organizing income categories, and using tools to automate the process. Proper tracking not only saves time but also sets your business up for growth.

Wave Accounting Tutorial for Small Business

Start Your Income Tracking System

Now that you understand why accurate income tracking matters, it's time to set up a system that fits your business.

Paper vs Digital Tracking Methods

Decide whether to use a paper-based or digital method. Paper methods involve manual entry, offering simplicity but often slowing you down and increasing the chance of mistakes. On the other hand, digital tools automate the process, provide real-time updates, and generate detailed reports. However, they require internet access and some initial setup.

| Method | Advantages | Disadvantages |

|---|---|---|

| Paper-Based | • No tech needed • Full control • Easy to start |

• Time-intensive • Error-prone |

| Digital Tools | • Automation • Real-time updates • Detailed reports |

• Needs internet • Learning curve |

Digital tools save time and effort, letting you focus more on growing your business. Let’s look at some of the best tools for digital income tracking.

Top Income Tracking Tools

QuickBooks Online offers features like automated bank feeds, cloud-based accounting, a mobile app, VAT tracking, and professional invoicing.

Wave is another popular option, especially for solopreneurs. Tatiyanna W. from TruCreates.com shares, "Wave makes your life a whole lot easier and takes that worry off you. I've tried QuickBooks - it's a bit more complicated and technical, and takes more time to set up". Wave boasts a 4.6 rating and provides free accounting tools, integrated payment processing, an intuitive interface, and mobile access.

After choosing a tool, the next step is to organize your income streams for better clarity.

Organize Your Income Categories

Categorizing your income streams ensures accurate tracking. According to LegalZoom Staff, "The key to organizing small business expenses is placing them in the right categories. These categories can help you budget and analyze your business' performance. It will also make it easier to identify expenses that qualify for tax deductions or credits quickly".

Here are some common categories to consider:

- Operating Income: Revenue from regular business activities

- Non-Operating Income: Earnings from sources like investments, interest, or rentals

- Product/Service Lines: Different revenue streams for your offerings

- Payment Methods: Separate by cash, credit, and digital payments

For better management:

- Use consistent labels and track income patterns to identify top performers.

- Regularly review and update categories as your business grows.

- Keep detailed transaction records for each category.

This structure will make it easier to analyze your business and stay on top of your finances.

Track Income Correctly

Keep Business Money Separate

Keeping your personal and business finances separate is key for accurate income tracking and legal protection. Chris Wong, head of Small Business Product at Bank of America, emphasizes, "A separate business account provides business owners with the ability to manage their business in one central location."

Here’s how to set up separate finances:

- Apply for an EIN: Get an Employer Identification Number (EIN) from the IRS to establish your business identity.

- Open business accounts: Set up a dedicated business checking account and a business credit card.

- Decide on your salary: Establish a fixed personal salary and stick to consistent withdrawals.

Once your finances are separate, focus on accurately capturing all revenue streams.

Record Every Income Source

With separate accounts in place, it's time to track every source of income. Here's how to handle different types of revenue:

| Income Type | Examples | How to Track |

|---|---|---|

| Operating Revenue | Daily sales, service fees | Use a digital POS system |

| Recurring Income | Subscriptions, memberships | Automated billing software |

| One-Time Payments | Project fees, consulting | Manual invoice tracking |

| Passive Income | Investments, royalties | Review monthly statements |

To stay on top of your income:

- Reconcile transactions with bank statements regularly.

- Use automation tools for digital payments.

- Keep digital copies of all receipts and invoices.

- Consistently categorize income streams.

Set Regular Recording Times

Regularly tracking income ensures a clear financial picture and helps with better decision-making. Instead of waiting until the end of the year, small businesses should record income consistently throughout the year.

Here’s a schedule to follow:

- Daily: Record cash transactions and reconcile POS systems.

- Weekly: Review and categorize income, then reconcile with bank statements.

- Monthly: Update financial reports and check overall performance.

- Quarterly: Analyze trends and fine-tune your tracking methods.

Start recording from day one of your business. Proper documentation is not just good practice - it’s essential for tax compliance and financial planning.

"Neither State Farm® nor its agents provide tax or legal advice"

sbb-itb-326adc9

Use Mobile Apps for Income Tracking

Mobile apps have changed the way small businesses manage their finances. In fact, 87% of businesses now use mobile applications for financial management tasks. These tools can complement your digital systems and make daily income tracking faster and more accurate.

What to Look for in a Tracking App

When picking a mobile income tracking app, focus on features that simplify managing your finances. Here's a quick breakdown:

| Feature Category | Must-Have Capabilities | Business Benefits |

|---|---|---|

| Basic Functions | Receipt scanning with OCR, Multi-currency support | Easier data entry, handles international transactions |

| Security | Two-factor authentication, End-to-end encryption | Keeps financial data safe, ensures secure transactions |

| Integration | Bank account sync, Accounting software connection | Real-time updates, smoother bookkeeping |

| Reporting | Custom reports, Analytics dashboard | Clear financial insights, better decision-making |

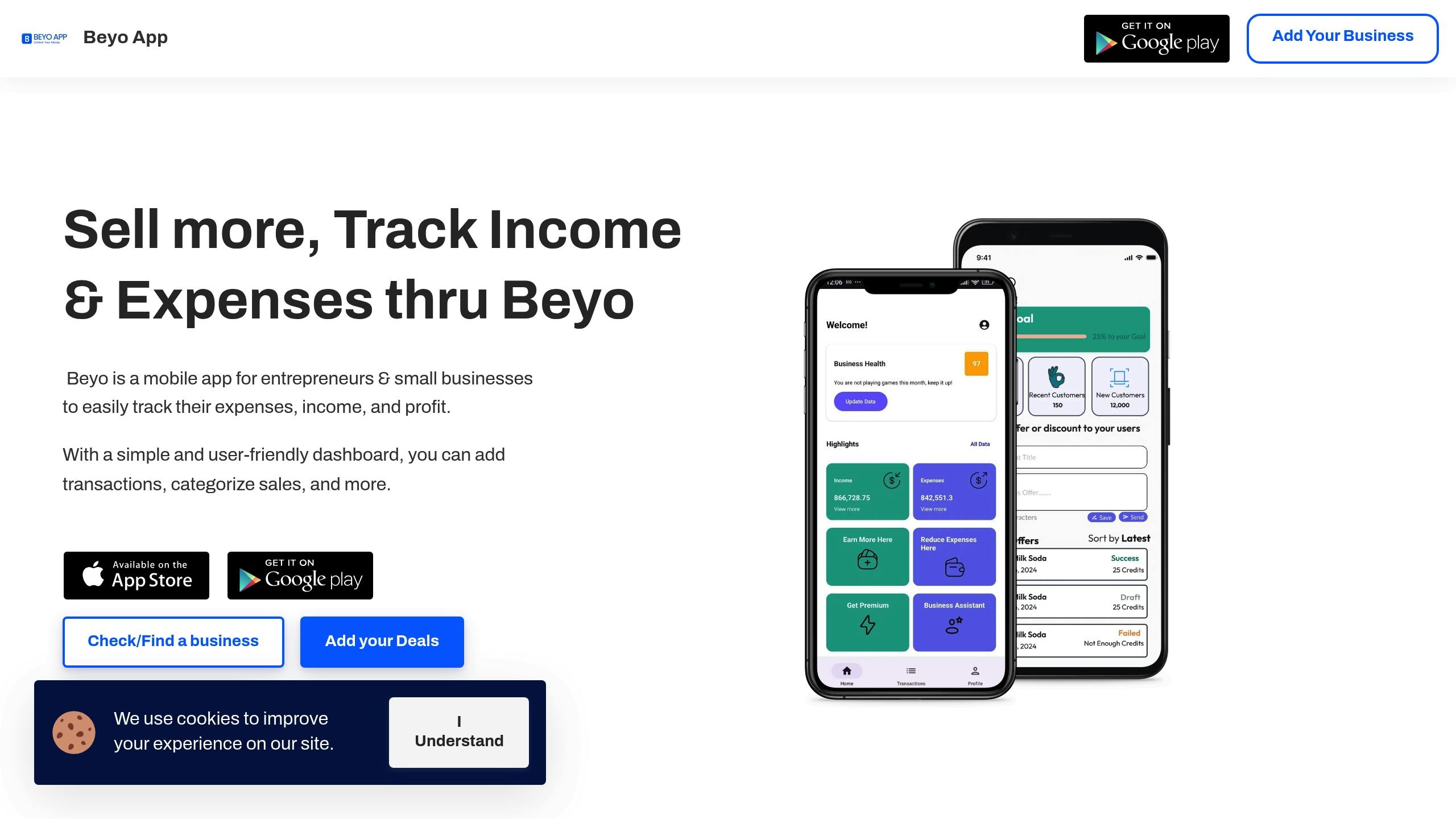

How to Use Beyo App

The Beyo App makes income tracking simple with its user-friendly design. Here’s how to get started:

- Set up your account and link your business bank accounts for automatic transaction imports.

- Customize categories to match your business's revenue streams.

- Enable notifications for incoming payments and important financial updates.

For businesses looking to grow, the Pro plan is available for $2.99/month. It offers advanced tools like profit analysis and expanded sales tracking. Once set up, you can focus on organizing your data and ensuring smooth transactions.

Tips for Secure and Accurate Tracking

To make the most of your mobile tracking setup, follow these security and accuracy tips:

- Use strong, unique passwords and enable biometric authentication if it's an option.

- Always connect through secure WiFi networks and avoid public connections for financial tasks.

- Keep your app updated with the latest security patches.

- Regularly compare mobile entries with your bank statements.

- Back up your data often to avoid losing important records.

"When using any kind of third-party tool, be sure to treat account security as a continuous and necessary step in your financial journey." – Equifax

To stay on top of your finances, make it a habit to review and categorize transactions daily. This helps you keep accurate records and gain better insights into your business's financial performance.

Use Income Data to Grow

When you have a reliable system for tracking income, you can use that data to drive growth. Income insights can guide smarter decisions. For example, companies that align their sales and marketing teams see 24% faster growth and 27% faster profit increases.

Read Your Income Reports

Income reports are a window into your business's financial health. Pay attention to these areas when reviewing your data:

- Revenue Analysis: Understand which departments or products contribute most to revenue. This helps with smarter resource allocation.

- Sales Pipeline: Look at conversion rates and deal sizes to refine your sales process.

- Customer Success: Focus on retention rates and upsell opportunities to build stronger customer relationships.

These insights can directly impact business growth. For instance, OnTheCloud analyzed their revenue and found that while their sales team generated 60% of their income, it was also their most expensive department. By shifting some resources to the customer success team - where costs were lower and retention rates needed improvement - they boosted overall profitability.

Find Income Patterns

Spotting patterns in your income helps you identify opportunities and address challenges early. Keep an eye on factors like:

- Seasonal trends (monthly or quarterly fluctuations)

- Product performance over time

- Regional differences in revenue

- Changes in customer behavior

For example, OnTheCloud observed their APAC revenue grow from $2.4M to $3.4M between May and October 2023. This pointed to a growing market they could capitalize on.

Set and Track Income Goals

Turn your financial vision into actionable goals using the SMART framework. Here’s how to make it work:

-

Set clear baselines

Start by reviewing your current income, expenses, and cash flow. This ensures your goals are realistic. -

Create measurable targets

Break larger goals into smaller, specific milestones. For example, if you want to increase monthly revenue, set weekly targets and track key metrics like conversion rates or sales calls. -

Monitor progress regularly

Use financial management tools to track your performance. Regular reviews help you spot issues early and adjust your strategy as needed.

"Financial goals are more than just numbers on a spreadsheet. They are the roadmap that helps you plan and make strategic decisions." – Lepper & Company, LLC

Conclusion: Start Tracking Today

Managing your finances is crucial - 40% of small businesses fail due to poor management. On the bright side, businesses using automated accounting tools save an average of 16 hours each month.

Quick Tips to Get Started

Here’s how to set up your income tracking system effectively:

- Open a separate business account to keep personal and business finances apart.

- Choose an accounting tool that fits your needs, like QuickBooks, Xero, Wave, or Beyo App's Basic plan.

- Update your financial records regularly to stay on top of things.

What to Do Next

Take these steps to keep momentum:

- Break the process into smaller goals to make it manageable.

- Digitize receipts and invoices for easy recordkeeping.

- Set aside time each week to review your financial progress.

- Automate recurring payments to cut down on manual tasks.

"At some point, the pain of not doing something becomes greater than the pain of doing it".

Start applying these steps today to take control of your business finances.